PRICING

PRICING

PRICING INFORMATION

Our compensation is due at the loan closing* and is normally paid through a submitted invoice to the settlement agent.

Our charges do not vary if the loan is taken over once conditional approval has been obtained.

There typically are not any charges associated with a loan file that does not close because of low appraisal, poor inspection, borrower’s loss of a job, etc. If a loan is withdrawn after loan approval is obtained, the processing fee may be due, at the discretion of the Director of Processing.*

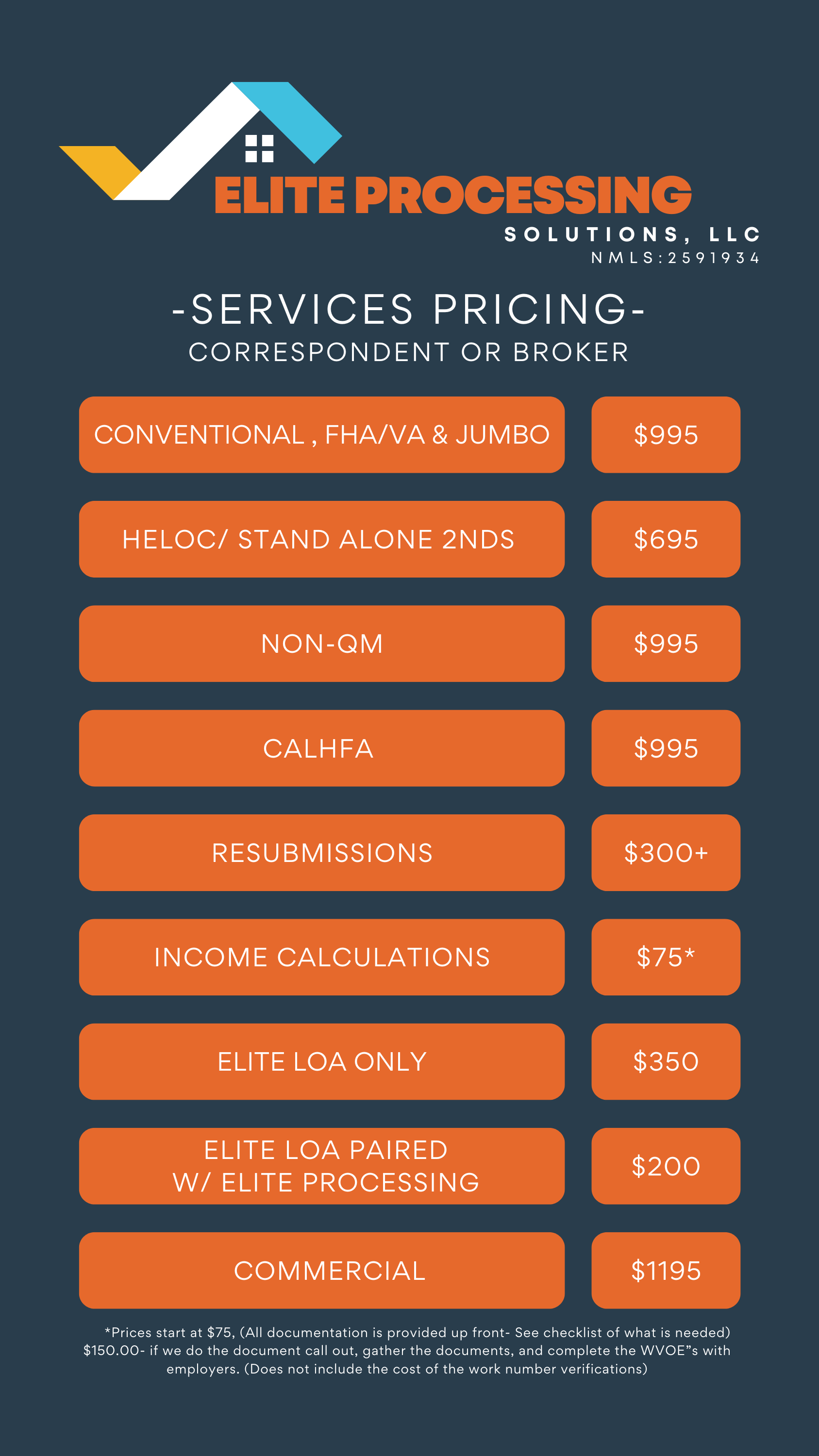

Our fees for processing and loan officer assistance services are a flat fee for all states.

SERVICES PRICING

We are a third-party, contract processing team to support Loan Originators, Mortgage Brokers and Mortgage Lenders reach their full potential.

Navigation

Contact Us

SUBSCRIBE

Join the Newsletter

Thank you for contacting us.

We will get back to you as soon as possible

We will get back to you as soon as possible

Oops, there was an error sending your message.

Please try again later

Please try again later